Înapoi la listă

Înapoi la listă

Rounding mode for the calculation of the total without VAT

If you create an invoice containing a position for which you enter the total value (and not the unit price of the position) because of the calculation method and the rounding for ‘Unit Price (VAT excluded)’, ‘Total VAT’ and ‘Total’, there may be a difference of $0.01 (1 cent) between the total position and the total amount of the invoice.

The explanation for these situations is the way of rounding amounts with 4 decimal places (representing the total without VAT calculated with 4 decimals) to two decimal values.

Rounding for 4 decimal places such as 16.8786, 16.8756, 16.8751 to a value of 2 decimal places will be 16.88 obvious, because each of those three values is closer to 16.88 than 16.87.

Also rounding for values with 4 decimals such as 16.8726, 16.8746, 16.8749 to a value of 2 decimal places will be 16.87 obvious, because each of those three values is closer to 16.87 than 16.88.

But for values like 16.7750 ‘approximation’ or difference to 16.78 is the same as the difference to 16.88 – and in these cases you can select the rounding mode.

To solve this kind of situation, our application offers the possibility to select the rounding mode for calculating the total value without VAT.

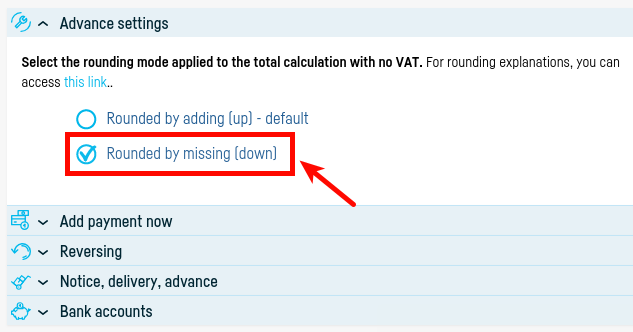

The app is set up by adding up – by default, opening the ‘Advanced Settings’ section also allows for ‘Missing (Down)’ option.

By selecting ‘Missing (Down)’

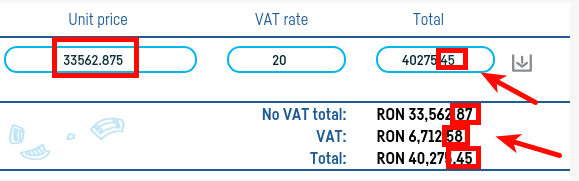

The result is:

The option must be selected before editing the unit price.

Înapoi la listă

Înapoi la listă